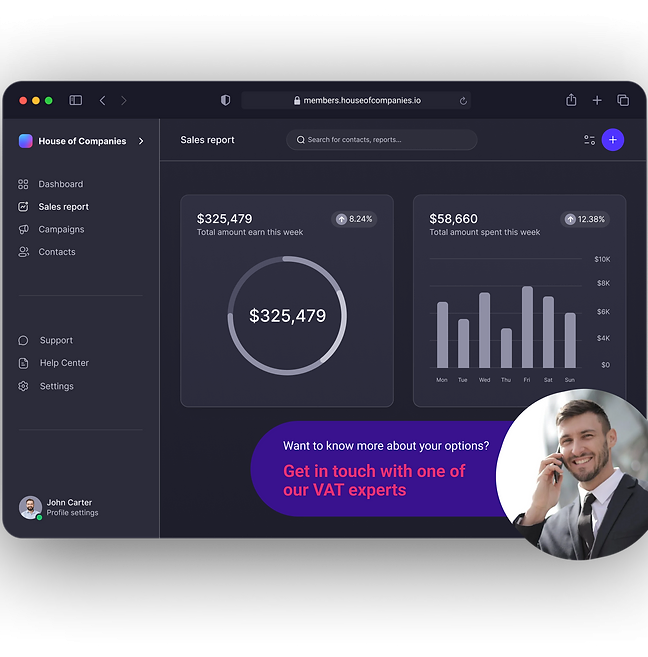

We are thrilled to offer our clients at House Companies the most comprehensive and cutting-edge bookkeeping services available in Italy! Our team of experts is equipped with the latest tools and technologies, which enable us to deliver innovative solutions that are tailored to meet your unique needs. With advanced and next-level support, you can rest assured that your bookkeeping needs are in the best possible hands. Let's get started!

It's becoming simpler every day to deliver and process invoices, bank statements, and even agreements (such as your lease) in Italy. The procedure of submitting your data is made simpler by House of Companies using a single source for all documents, data and reports, fully compliant with Italian regulations. You can track our progress, and your profits, in real-time!

"The transition to quarterly VAT returns was daunting, but House of Companies made it effortless. Their system integrated perfectly with our existing processes."

Global Talent Recruiter

Global Talent Recruiter"As a startup in Italy, managing our finances was challenging. House of Companies simplified our bookkeeping and tax compliance, enabling us to focus on scaling our business while staying compliant with all Italian regulations."

Spice & Herbs Export

Spice & Herbs Export"For years, we struggled with our bookkeeping and tax filings. Since using House of Companies, we’ve been able to streamline everything. Their platform is easy to use, and they’ve helped us stay compliant with Italy’s tax rules with minimal stress."

IT firm

IT firmItaly has a corporate tax rate of 24% for most companies, which is one of the standard rates applied to corporate profits. However, smaller businesses with annual revenues below €400,000 may benefit from a reduced rate of 15% on the first €200,000 of taxable income. This tax regime is designed to support smaller companies and startups while maintaining competitive taxation for larger entities.

Dividends distributed to both residents and non-residents are subject to Italian withholding tax at a standard rate of 26%. However, Italy has tax treaties with several countries that may reduce this withholding tax rate. For non-resident companies in countries with which Italy has a tax treaty, the dividend tax rate can be reduced, often to 15%.

Italy offers significant tax incentives for companies engaged in Research and Development. The R&D tax credit program allows businesses to claim up to 12% of their qualifying R&D expenses, with additional credits available for innovative projects in certain sectors. These incentives aim to support technological advancement and innovation within the Italian economy.

Italy adheres to OECD transfer pricing guidelines for transactions between related parties. Companies must ensure that intercompany transactions are conducted at arm’s length, which means that the terms of the transactions must reflect what would be agreed upon between unrelated parties. Italy’s tax authorities have robust rules in place to monitor and enforce compliance with these guidelines, particularly for multinational corporations engaging in cross-border trade.

Your circumstance may actually call for the assistance of a local tax professional, given the complex nature of Italian tax and accounting regulations. A local accountant may be required by law for certain business activities in Italy. If you need help filing your tax return with the Agenzia delle Entrate, House of Companies is here to help. You can either send us your existing ledgers and VAT Analysis, or instruct us to draw up new ones from scratch, ensuring full compliance with Italian tax laws.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!