One Control Panel to handle your company's incorporation and other corporate challenges during your global expansion. House of Companies offers the most cost-effective and efficient way to incorporate your company overseas, including the tools and community to make your market entry in Italy successful.

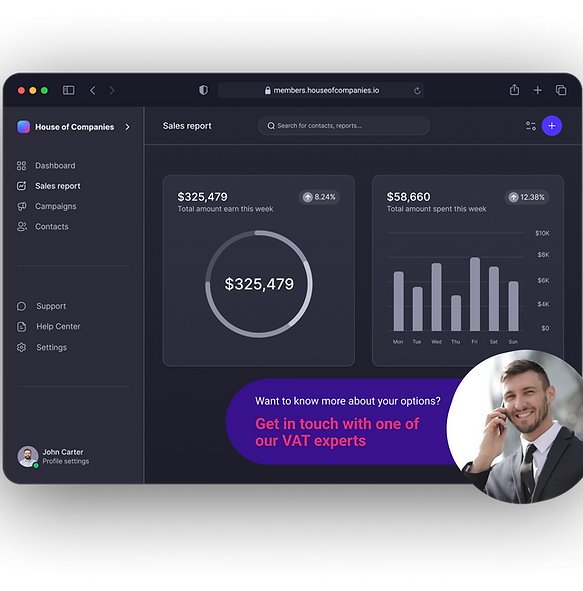

Filing your VAT returns in Italy is becoming simpler every day. The growing number of "online tax portals" available to international business owners simplifies the process of submitting your VAT return. When you sign up for a Free Trial, try using our Entity Management to submit your VAT return in Italy.

Once your first VAT return is submitted, you can use Entity Management to further run & grow your company in Italy!

"Clear communication and precise filing. I finally feel confident about my tax compliance in Italy."

Emily Jacobs

Emily Jacobs "Their guidance saved me from costly errors. I trust them with all my VAT submissions."

Carlos Hernandez

Carlos Hernandez"Great attention to detail and fantastic customer support. I never worry about VAT deadlines anymore."

Haruto Nakamur

Haruto NakamurDespite the comprehensive nature of our Entity Management contents, your situation may require the assistance of a local tax professional. In Italy, a local accountant may be required by law for certain types of businesses or transactions.

If you need help filing your VAT return in Italy, House of Companies is here to assist you.

At House of Companies, we stay up-to-date with the latest Italian VAT regulations to ensure your business remains compliant. Our team of experts can guide you through the complexities of Italian VAT law, including recent changes and special requirements for e-invoicing.

Trust House of Companies for your VAT filing needs in Italy. We combine local expertise with global business understanding to make your Italian market entry and ongoing operations smooth and compliant.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!