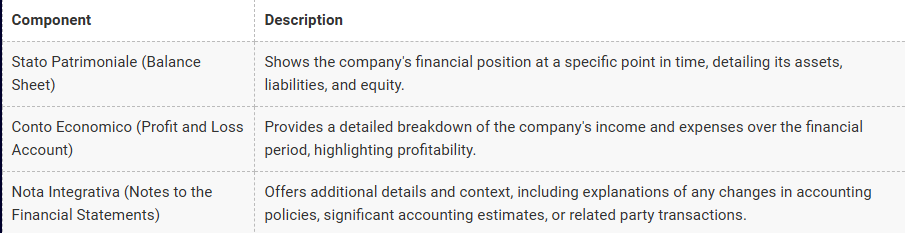

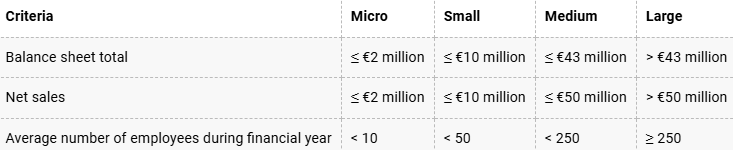

Industry-specific bookkeepers offer invaluable expertise, particularly for businesses operating in Italy. These professionals possess in-depth knowledge of local financial regulations, tax implications, and sector-specific best practices. Here’s how they can support businesses in Italy:

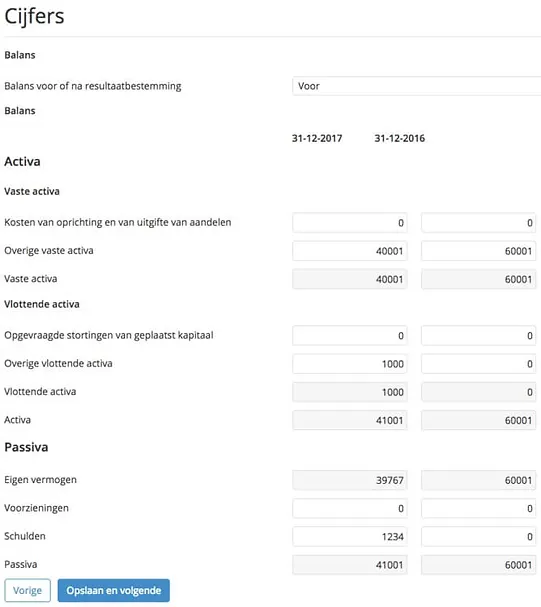

Protect Your Financial Policies: Bookkeepers ensure your organization adheres to Italy's accounting principles, protecting you from non-compliance penalties under Italian GAAP or IFRS.

Adherence to Local and EU Regulations: Given Italy’s membership in the EU, bookkeepers ensure compliance with EU Directives and local regulations governed by the Agenzia delle Entrate (Revenue Agency) and other regulatory bodies, helping businesses remain compliant with VAT, corporate tax, and payroll taxes.

Quick Error Identification: Italy-specific accounting tools and practices help quickly identify discrepancies, such as VAT miscalculations or incorrect payroll tax filings, and address issues early, minimizing risk.

Maintain Strong Commercial Awareness: Industry-specific bookkeepers in Italy work with a wide range of stakeholders, ensuring businesses stay competitive, compliant, and financially sound in both local and international markets. They provide insights that enhance strategic decision-making, improve tax planning, and facilitate smooth operations across industries.

With their specialized knowledge, these bookkeepers can help businesses navigate the complex regulatory and financial landscape of Italy while ensuring their operations remain efficient and compliant.