At House of Companies, we specialize in providing a comprehensive service that assists e-commerce entrepreneurs in streamlining and automating the VAT return process, making selling within the Italian and European markets more seamless.

With our expert solutions, you save time and money, while eliminating the complexities of VAT compliance in Italy. Focus on expanding your business globally without the burden of international tax concerns.

House of Companies provides comprehensive solutions for e-commerce entrepreneurs to streamline international sales, with a focus on Italian VAT regulations. By optimizing and automating the VAT return process, we enable seamless expansion into new markets without the burden of complex tax compliance.

Our cutting-edge Document Scanning and Validation service ensures accuracy and efficiency in managing essential documentation for Italian VAT returns. Furthermore, our platform facilitates real-time VAT reporting tailored to the specific requirements of Italy and other EU countries, empowering businesses to navigate international growth with confidence and ease.

"Thanks to House of Companies Italy, I save hours each month on VAT filing. Their service is efficient, reliable, and has greatly simplified my VAT compliance process. I no longer worry about missed deadlines or errors!"

Silvia G

Silvia G"Automating VAT with House of Companies Italy was smooth and stress-free. Their system handled everything seamlessly, making the process effortless. I now feel much more confident about my tax filings!"

Paolo M

Paolo MVAT filing system is incredibly user-friendly and cost-effective. It simplified my VAT process and saved me time. I highly recommend it to any business owner looking for a reliable solution!"

Riccardo S

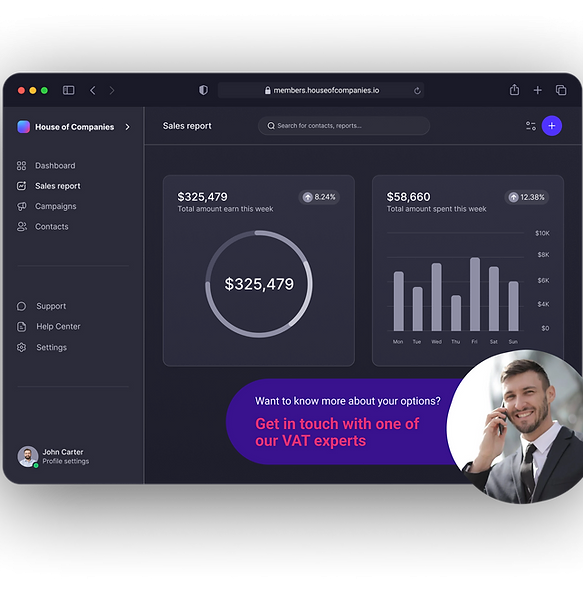

Riccardo SPartnering with our VAT experts at House of Companies allows you to leverage the benefits of automation while receiving personalized support to navigate the intricacies of Italian VAT compliance. Contact us today to explore how our dedicated VAT support can elevate your automated VAT process and drive financial efficiency for your business in Italy.

At House of Companies, we understand the challenges businesses face in navigating the complex landscape of Italian VAT compliance. That's why we offer dedicated support from our team of VAT experts to complement your automated VAT process. With our specialized assistance, you can streamline your VAT compliance and reclaim processes while ensuring accuracy and efficiency in the Italian market.

Partnering with our VAT experts at House of Companies allows you to leverage the benefits of automation while receiving personalized support to navigate the intricacies of Italian VAT compliance. Contact us today to explore how our dedicated VAT support can elevate your automated VAT process and drive financial efficiency for your business in Italy.

Standard VAT rate in Italy: 22%

Reduced rates: 10%, 5%, and 4% for specific goods and services

VAT is known as IVA (Imposta sul Valore Aggiunto) in Italy

Mandatory e-invoicing system: Sistema di Interscambio (SDI)

Quarterly or monthly VAT returns based on turnover

Annual VAT return deadline: April 30th of the following year

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!