At House of Companies, we're excited to offer our clients the most comprehensive and innovative bookkeeping services available in Italy! Our team of experts leverages cutting-edge tools and technologies to deliver tailored solutions that meet your unique needs. With our advanced support, you can be confident that your bookkeeping is in the most capable hands. Let's embark on this journey together!

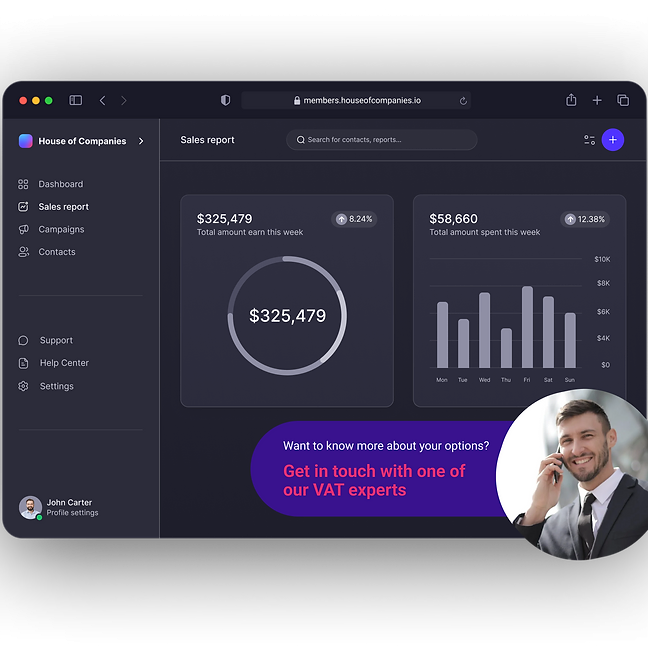

The process of managing invoices, bank statements, and even agreements (such as leases) is becoming increasingly streamlined in Italy. House of Companies simplifies your data submission process by providing a single source for all documents, data, and reports. You can monitor our progress and your profits in real-time, ensuring compliance with Italian regulations!

"As an American entrepreneur expanding to Italy, I was overwhelmed by the tax regulations. House of Companies made it seamless, handling everything from IRES to VAT.

Global Hiring Manager

Global Hiring Manager"House of Companies helped us navigate the complex world of transfer pricing in Italy. Their expertise saved us from potential compliance issues and penalties."

Spice & Herb Exporter

Spice & Herb Exporter"As a UK-based company with Italian subsidiaries, we needed specialized help. House of Companies provided tailored solutions that addressed our unique cross-border tax challenges."

Tech Company

Tech CompanyGiven the complexity of Italian tax and accounting regulations, your situation may require the expertise of a local tax professional. In fact, Italian law mandates the use of a local accountant for certain business activities. If you need assistance with your Italian tax return, House of Companies is here to help. You can either provide us with your existing ledgers and VAT analysis, or instruct us to create new ones from scratch, ensuring full compliance with Italian tax laws.

Expert knowledge of Italian tax laws, including recent reforms and the implementation of Pillar Two

At House of Companies, we stay abreast of the latest developments in Italian tax legislation, ensuring that your business remains compliant while optimizing your tax position. Our services are designed to give you peace of mind, allowing you to focus on growing your business in the Italian market.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!